Stress Testing Your Portfolio

2007 was a landmark year as the 9th of October marked the peak of the stock market (Dow Jones). Crunchy leaves weren’t the only thing beginning to fall in October, though. This time also marked the beginning of a significant decline.

Backtrack a few years to 2001. Following 9/11, the U.S. stock market experienced a bull market from 2002-2007. Then in March 9th, 2009, the market bottomed out with the Dow down 54% since October 2007. Maybe people lost their jobs. Others lost their retirement savings.

Stress Testing For Declines

Understanding the past declines in the stock market can certainly help you temper expectations and stress test your portfolio. Stress testing is a method for exploring how your portfolio will perform during a financial crisis. This is widely used by the banking industry and finance professionals.

The banking, credit, and real estate industries were to blame in the 2008-2009 decline in the market, but there are measures that could have been taken to prevent a crash. Many analysts admit that the lack of proper asset allocation and stress testing contributed to bigger losses for individual portfolios.

Stress Testing With The Monte Carlo Simulation

The Monte Carlo Simulation (or Monte Carlo Method) is a popular simulation to stress test and guess certain outcomes in a portfolio, used in the finance industry. This method helps you see the possible outcomes of your decisions and assesses the impact of risk. In retirement, the Monte Carlo Simulation is valuable in determining the probability of running out of money, based on various asset allocations.

Let’s look at a stress test example for a retirement portfolio. When planning for retirement, the first step, although an obvious one, is to determine how much savings you’ll need to live comfortably in retirement. Most people don’t realize that the accumulated amount isn’t the important number, but rather the income it will generate in retirement.

Example Of Stress Testing Your Portfolio

As an example, an investor saves $1 million and plans to retire in five years. Let’s assume a 5 percent withdrawal rate at retirement, giving this investor $50,000 annually of income. Now let’s also project (or stress test) a 25 percent loss in the portfolio. The new accumulated asset will be $750,000, which will now generate $37,500 annually. This is a loss of more than $1,000 of retirement income every month! Utilizing a Monte Carlo Simulation or other method of stress testing, one could plan with possible ways to minimize loss and risk.

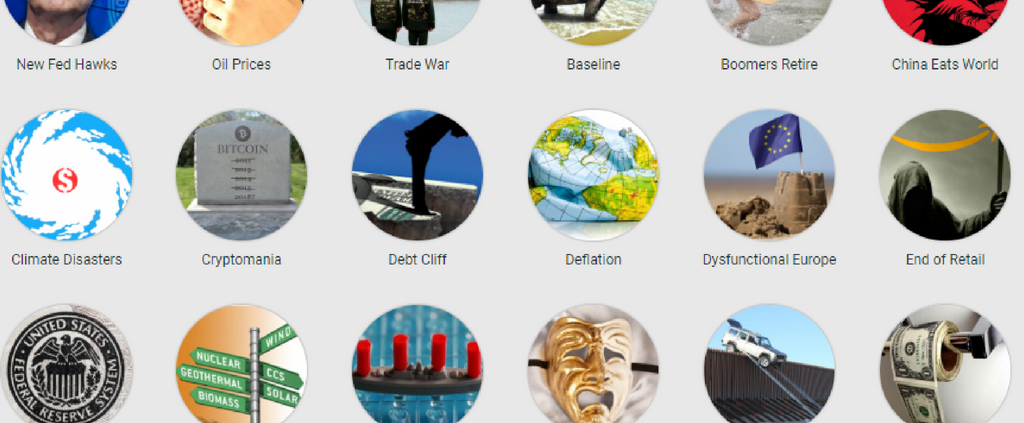

Perhaps if a simulation shows the portfolio increasing in a certain asset class, and reducing in another asset class, the portfolio may lose only 15 percent of value rather than the 25 percent previously suggested. This might be increasing or decreasing in a sector or industry, such as oil or real estate. Rather than a sector, it may be changing the allocation for equities, bonds, hedge funds, or options. We also utilize tactical managers in addition to our own internal approach.

Prepare With Stress Testing

There is no way to predict with certain what the stock market may do in the future, but through stress testing your portfolio with simulations you can certainly be prepared. We can show you a snapshot of your current portfolio and the probability of reaching your goals, therefore allowing you to make changes to improve your chances of success. You can call me direct at Axxcess Wealth Management at 858.217.5347 and we’d love to help you. Click here to take a risk survey to see how financially prepared you are.

About Kevin

Kevin Manzo is a Financial Advisor with Axxcess Wealth Management. Kevin’s services are especially valuable to business owners, high-income and high-net-worth professionals and their families. After 12 successful years as a portfolio manager and advisor Kevin has the knowledge and experience to help clients protect what they’ve worked for, enjoy a comfortable retirement, and leave the legacy they choose for their heirs. Along with his Bachelor’s of Business Administration degree in Finance from Chapman University, he also holds the Accredited Investment Fiduciary® credential, signifying his commitment to upholding a high level of fiduciary care for his clients. Based in Fullerton, California, he serves families and business owners throughout North Orange County and Los Angeles. Learn more by connecting with Kevin on LinkedIn.