Athena Global ETF- Feb 13 2018 Update

Athena Global Tactical ETFs Update

With recent market volatility, we have advisors and clients asking about potential position changes to our Global Tactical ETFs portfolio. Tactical managers use different approaches including economic conditions, momentum and valuation. These signals can be short, intermediate or long-term in nature. We use longer-term deep behavioral currents and don’t react to short-term market volatility or drawdowns. The portfolio will typically hold positions for 6-9 months.

We are currently long the S&P 500 and will maintain our position until we re-evaluate our data again in early March. Our market barometers are updated monthly and continue to have expected returns in the normal range of 10% annualized. While the portfolio can move 100% to cash, this usually occurs only in catastrophic scenarios where our barometers sustain dramatic deterioration over time. We rely on our methodology to take the emotions out of the process and this approach has served us well.

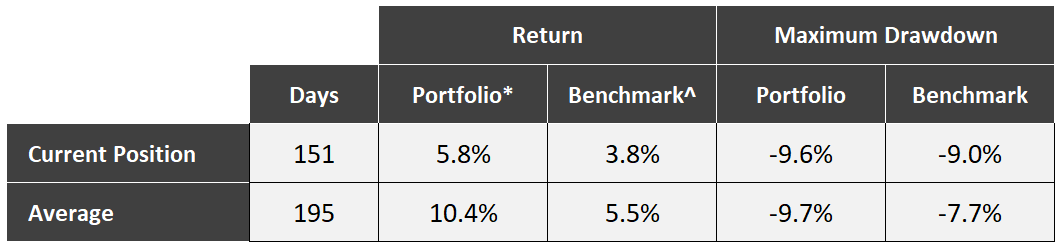

The table below provides some perspective on our current S&P 500 position as of 02/09/2018 versus the average of all portfolio positions since inception in September 2010. Our current drawdown is in-line with the average drawdown of our historical positions and that of our benchmark.

Portfolio performance is Net of Fees. Portfolio and Benchmark Returns and Drawdowns are not annualized.

^ Benchmark is MSCI ACWI NR Index View Full Portfolio Disclosures

The current economic, fundamental and behavioral indicators continue to remain solid. Please reference our monthly Market View. For suggestions on helping clients, please refer to our Behavioral Advisor Materials. Sometimes it is just as important to not trade and stay invested through the volatility and drawdowns as it is to exit the market.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE PERFORMANCE.

Dave Stock

(917) 771-1437

david.stock@athenainvest.com

Steve Bogosian

(314) 562-2223

steve.bogosian@athenainvest.com