OUR INDUSTRY IS GRAPPLING BETWEEN “VIRTUALLY FREE” ONE-SIZE-FITS-ALL MODEL PORTFOLIO MINDSET, AND A CUSTOMIZED INVESTMENT PORTFOLIO APPROACH FOR CLIENTS.

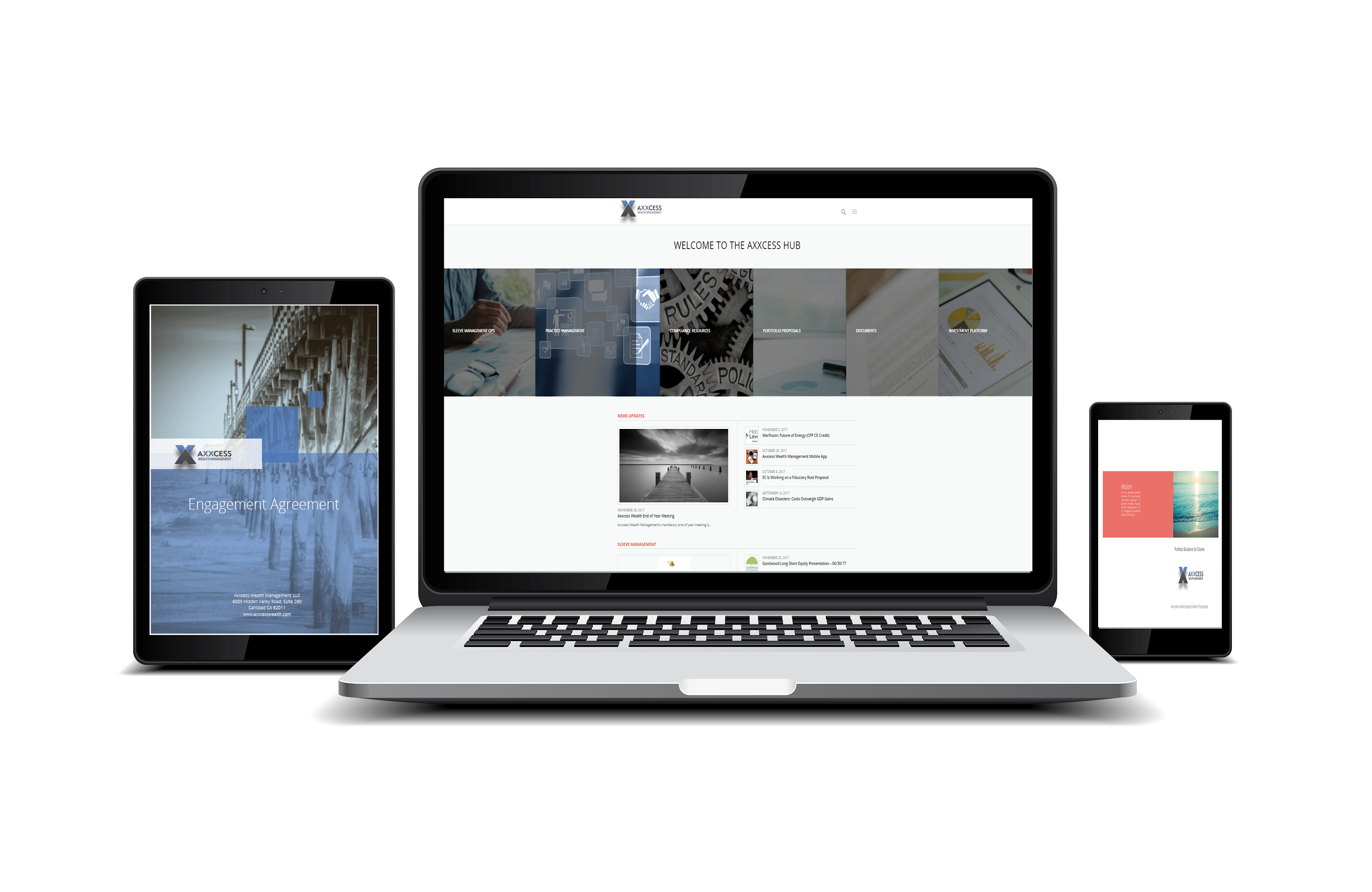

Our view remains that high net worth investors demand institutional-quality managers, analytical technology, maximum transparency, independent service providers, and control over their investment decisions.