Goldman Sachs Quarterly Commentary

Q2 MARKET REVIEW

- US equity markets continued to outperform developed market peers in Q2, gaining 4.5% and reaching a new all-time high. These gains remained narrow in scope, however, with the M7 rising 16.9% while the equal-weighted S&P 500 fell by 2.6% and the small-cap Russell 2000 went down 3.3%.

Internationally, Japanese equities (TOPIX) were up 1.7% and Euro Area equities (SX5E) were down 1.3%, with most of the loss coming in June following the increased uncertainty due to the French and UK snap elections.

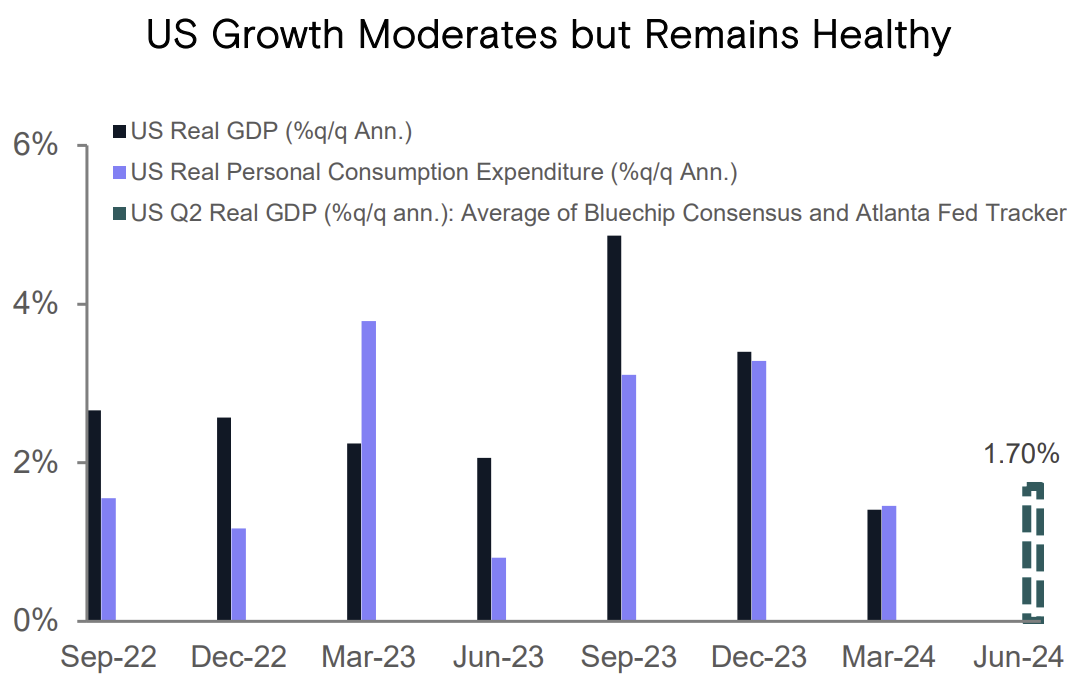

We continued to see positive momentum in risk assets on a year-to-date basis, along with signs of improvement in global manufacturing PMIs, a healthy labor market, strong earnings growth, and expectations of policy easing by major central banks. - Q2 also saw a return to the disinflationary trend in the US with lower core PCE, lower GDP, and a slowdown in private consumption. Moderation in job openings has also been an encouraging sign of labor market rebalancing. Job openings remained on a downward trend with a latest reading of 4.9% versus the post pandemic peak of 7.4%. The resiliency of the labor market remains a headwind to the FOMC’s effort to achieve its 2% inflation target.

- Among the US sectors, technology (XLK) outperformed as it rallied 8.8%, followed by utilities (XLU), which was up 4.6%. On the other hand, materials (XLB), industrials (XLI), and energy (XLE) underperformed noticeably with selloffs of 4.5%, 2.9%, and 2.7% respectively.

- Commodities had a mixed quarter with oil (WTI) down 2%, however metals had a strong performance. Copper, gold, and silver were up 10%, 5.5%, and 17% respectively. Overall, commodities have delivered strong returns in the first half of 2024 with oil (WTI) up 15% and copper up 13% respectively. Gold and silver have rallied 13% and 22% respectively in the first half of the year.

PERFORMANCE REVIEW

Q2 performance was positive across risk profiles, with equities contributing strongly to outperformance versus the benchmark, driven mostly by domestic large cap equities. All risk profiles outperformed their benchmarks mostly due to a bias towards US equities.

Resilient macroeconomic data and earnings growth continue to provide a constructive backdrop for US equities and a soft-landing narrative. We maintained our overweight to US large cap and international developed equities from Q1, which helped to drive performance. Our underweight in small cap exposure also helped avoid further drawdown as returns remained concentrated in the largest names, especially the Magnificent 7. Both our ActiveBeta and MarketBeta US Equity exposures were the largest contributors to positive total portfolio returns and continue to offer attractive diversification across equity styles.

- The probability of a soft landing in the US remains our base case scenario. Despite uncertainties from geopolitical tensions and the upcoming US election, our outlook for US equities remains constructive given resilient activity data, strong earnings, and expectations for lower rates.

- The timing and magnitude of further policy rate calibration becomes very crucial as easing too soon could reignite inflationary pressures and waiting too long could break the labor market. A further slowdown in consumption and job growth could be worrying for policy makers and market participants, renewing fears of a recession. As a result, we believe the Fed will become more balanced between its dual mandate of inflation and full employment compared to a year ago when the FOMC was squarely focused on inflation.

- US growth is expected to moderate from its recent strong pace but remain healthy, supported by resilient domestic demand. While the Fed has yet to begin the easing cycle, we expect rate cuts to commence later this year as recent data suggests the labor market is softening and progress is being made in bringing inflation down. In the short term, we expect to see continued divergence between the Fed and the ECB, which partially factors into our constructive view on global developed market equities outside of the US.

- Within US equities, we expect earnings growth convergence between mega-cap tech stocks and the broader market over the next 3-4 quarters, leading to increased breadth in market performance.

- In Europe, we see an improving growth/inflation mix supported by the ECB’s decision to cut rates by 25 bps in June despite a moderate increase in the projected core inflation path. The move was motivated by the reduction in upside inflation risks which warrants a modest decline in the degree of restriction. Going forward the ECB will remain in data dependent mode. The most plausible scenario is quarterly rate cuts for the remainder of the year.

- We see opportunity in Japan as it is in an earlier stage of the business cycle relative to other markets. We expect consumption to improve due to better real wage growth allowing the Bank of Japan to begin modest rate hikes while remaining accommodative to growth.

- In China, after better-than-expected growth in the first months of the year, growth momentum has softened. The main short-term growth headwinds come from the real estate crisis and low consumer confidence while the main medium-term growth risk continues to come from low business confidence stemming from state interventionism and regulatory uncertainty.

DISCLOSURES

Multi-Asset Solutions, as of June 30, 2024. Past performance does not guarantee future results, which may vary. There is no guarantee that these objectives will be met. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Any mention of an investment decision is intended only to illustrate our investment approach and/or strategy and is not indicative of the performance of our strategy as a whole. It should not be assumed that any investment decisions shown will prove to be profitable, or that any investment decisions made in the future will be profitable or will equal the performance of the investments discussed herein. Diversification does not protect an investor from market risk and does not ensure a profit. The investment manager may change the allocations over time. Allocations may not be representative of current or future investments. Goldman Sachs does not provide accounting, tax or legal advice. Please see additional disclosures at the end of this presentation.

CONFIDENTIALITY NOTICE: This email may contain privileged or confidential information and is for the sole use of the intended recipient(s). Any unauthorized use or disclosure of this communication is prohibited. If you believe that you have received this email in error, please notify the sender immediately and delete it from your system.

NO OFFER OR SOLICITATION: The contents of this electronic mail message: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, and (ii) may not be relied upon in making an investment decision related to any investment offering Axxcess Wealth Management, LLC, an SEC Registered Investment Advisor. Axxcess does not warrant the accuracy or completeness of the information contained herein. Opinions are our current opinions and are subject to change without notice. Prices, quotes, rates are subject to change without notice. Generally, investments are NOT FDIC INSURED, NOT BANK GUARANTEED and MAY LOSE VALUE.

This message may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

AWM often communicates with its clients and prospective clients through electronic mail (“email”), short message service (“SMS”), and other electronic means. Your privacy and security are very important to us. AWM makes every effort to ensure that electronic communications do not contain sensitive information. We remind our clients and others not to send AWM private information over email. If you have sensitive data to deliver, we can provide secure means for such delivery.

Please note: AWM does not accept trading or money movement instructions via email.

All emails and business-related SMS communications are sent through systems that can be archived and monitored. Please contact us at www.axxcesswealth.com for our approved texting number. As a registered investment advisor, AWM emails and SMS communications may be subject to inspection by the Chief Compliance Officer (“CCO”) of AWM or the securities regulators.

If you have received an email from AWM in error, we ask that you contact the sender and destroy the email and its contents.

If you have any questions regarding our email policies, please Contact Us.