your

Mariah Wisely is an Investment Advisor with Axxcess Wealth Management who joined the firm in 2018. She was born and raised in Atlanta, Georgia where she attended Georgia Southern University and Georgia Gwinnett College and went on to achieve a B.S.B.A Degree in Finance. While in college, she was president of the Finance Club and spent time tutoring students in finance, statistics, calculus, and accounting.

Mariah has a strong passion for retirement planning with a focus on 401(k) plans, 403(b) plans, and defined benefit plans. She enjoys crafting retirement plans for business owners, benchmarking and improving plans, while educating employees on the benefits of saving for their future. She also provides portfolio management and financial planning to individual clients.

Prior to joining Axxcess, Mariah interned then for a large wealth management firm in Atlanta, Georgia where she gained experience in portfolio management and retirement planning.

Mariah enjoys anything outdoors and adventurous. She loves hiking, rock climbing, kayaking, and weightlifting. Her and her husband welcomed their first daughter in 2022 named Blake Alison Wisely. She travels back and forth from Orange County to Atlanta regularly.

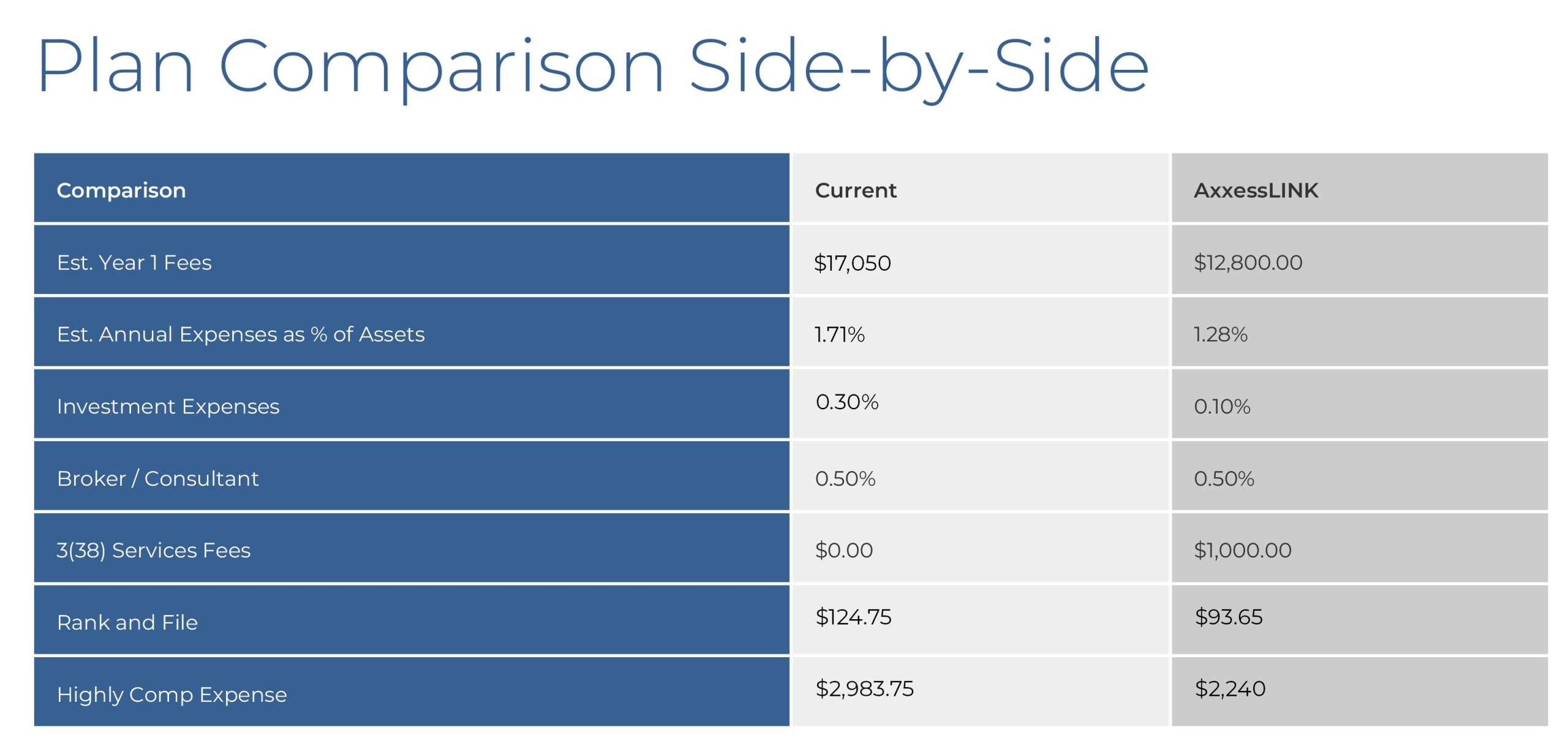

recordkeeping, which increase as the plan grows

in size but the service level does not change.

AxxcessLINK is a retirement recordkeeping

system that avoids asset based fees for

recordkeeping services. Instead, participants pay

one flat fee regardless of their account size in the

plan.

Participants have the flexibility to hire who they

trust. AxxcessLINK can help independent

investment advisors manage your participant

account allocation to help you keep on track

towards your goals.

for you and presents a “black and white” plan

analysis leaving no gray area. This allows plan

sponsors to make educated decisions in the best

interest of the plan and its participants, based on

clearly defined information.

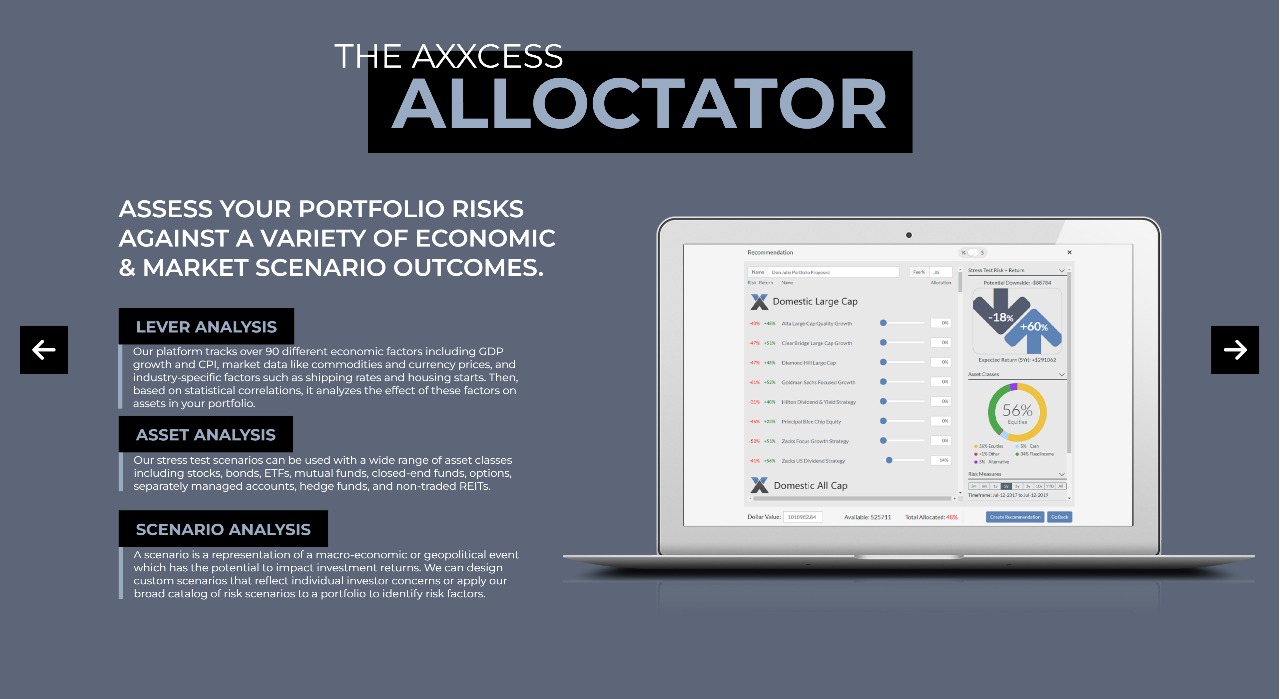

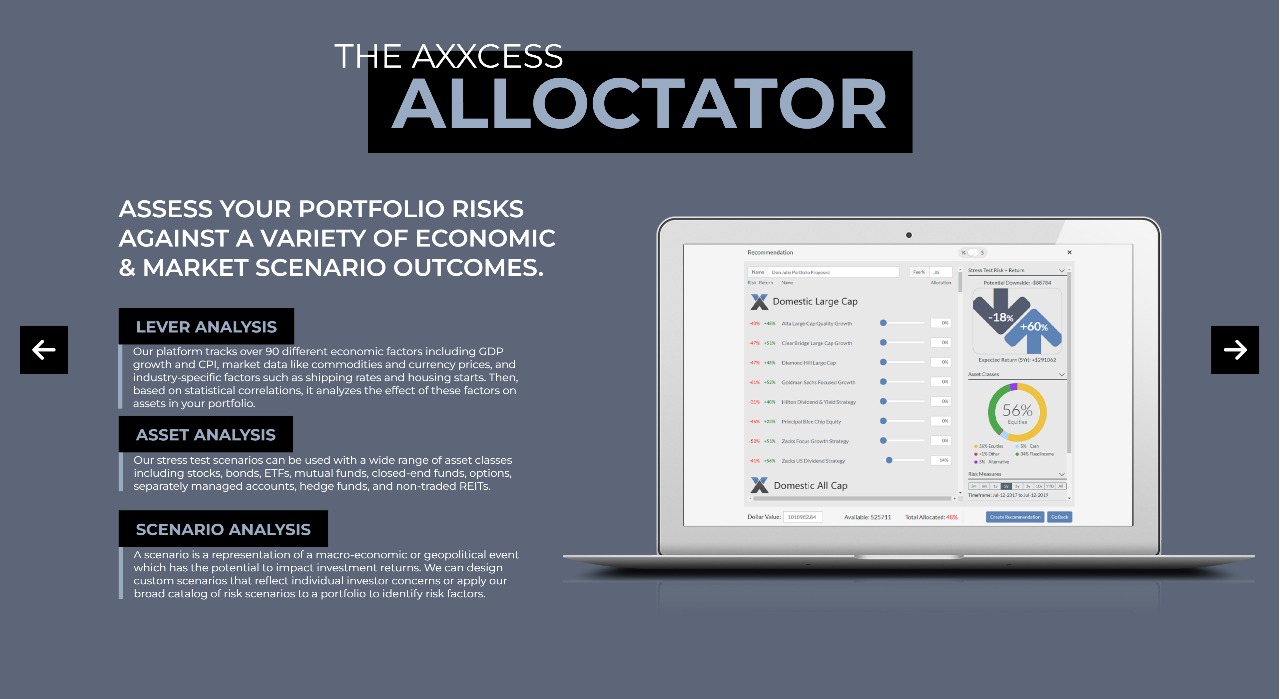

help participants make good decisions about

their investments. Participants can track and

manage outside accounts, project and stress test

retirement income outcomes. AxxcessLINK can

add a self directed brokerage option for

participants to be able to allocate to a wider

range of investment options outside of the plan’s

core menu.

RETIREMENT

• Provider Search/RFP

• Fi360 Diligence and plan analytics

• Individual portfolio management

• Ongoing research, diligence, and monitoring

• Fiduciary investment advice

• Private equity, real estate, and hedge funds

• Choice of custodial relationship

• Defined benefit plan design

• Pooled account investment management.

• Qualified and NQ plan advisory

• Executive compensation

• Recruitment

• Retention

• Short/long term incentives

• Personal P and L, and balance sheet reporting.

• Comprehensive asset statements (monthly and annually)

• Business and deal evaluation

• Estate planning and analysis

Vetting & Diligence

• 3(21) and 3(38) fiduciary liability guidance

• Investment policy statement drafting

• Committee governance

fees in minutes